Roof replacement is one of the biggest home expenses you’ll ever face, so if there’s any chance it can lower your tax bill, you need to know before you spend a dime.

For most homeowners, the answer is no, a new roof isn’t tax-deductible if it’s installed on a primary residence. Still, there are exceptions, and a roof replacement can provide tax benefits in certain cases. Your tax outcome depends on why the roof was replaced and how the home is used, so it’s important to understand the rules and keep good records.

Table of Contents

Highlights✔ Most primary residence roof replacements are not directly tax-deductible. |

Is a New Roof Tax Deductible for Homeowners?

Most homeowners hope the IRS treats roof replacement like a deductible home expense. It doesn’t—at least not in the way people assume.

In general, if your home is your primary residence and you replace your roof, that cost is not deductible as a standard tax write-off. The IRS typically treats roof replacement as a personal home improvement, not a deductible expense.

That said, a roof replacement can still help your taxes in specific situations, including:

- When the property is a rental

- When part of your home is used for business (home office)

- When the upgrade qualifies for certain energy tax incentives

- When you sell your home later and want to reduce capital gains

Understanding the difference between a “deduction,” a “credit,” and an “investment that lowers future taxes” is what separates homeowners who lose money from homeowners who keep more of it.

Is a Roof Replacement Tax Deductible Under IRS Rules?

Roof replacement falls into a tax category that trips people up: it’s usually an improvement, not a repair.

That matters because repairs and improvements are treated differently by the IRS, especially for rental properties and home office claims.

Roof Replacement as a Capital Improvement

A roof replacement typically qualifies as a capital improvement because it:

- Adds value to the home

- Extends the useful life of the property

- Improves structural integrity and performance

For tax purposes, capital improvements are handled differently depending on how the property is used:

- Primary residence: added to cost basis, not deducted immediately

- Rental property: depreciated over time

- Home office: may be partially deductible

Repairs vs Replacement: What the IRS Treats Differently

Repairs are usually considered routine maintenance. They maintain a home’s condition without significantly increasing value or lifespan.

Examples of repairs:

- Fixing a small leak

- Replacing a few shingles

- Sealing flashing

- Patching roof damage

Examples of replacement or improvement:

- Full tear-off and re-roofing

- New underlayment and ventilation system

- Structural decking replacement

- Major upgrade to roofing materials

If you’re wondering, “Is a roof replacement tax deductible?” the IRS distinction here is the backbone of the answer.

Documentation Homeowners Should Keep

If you spend thousands on a new roof and don’t keep documentation, you lose your best chance to claim any future tax advantage.

Keep:

- Signed contract and final invoice

- Itemized materials and labor breakdown

- Proof of payment

- Warranty documents

- Before-and-after photos

- Any inspection reports

This documentation helps support:

- cost basis increase

- rental depreciation claims

- home office deductions

- energy credit eligibility (if applicable)

When Can I Claim a New Roof on My Taxes?

If you’ve asked, “can I claim a new roof on my taxes,” the answer depends less on the roof and more on how your home is used.

If You Have a Home Office (Potential Partial Deduction)

A roof replacement may be partially deductible if you qualify for the home office deduction and you use the “actual expense method.” That means you deduct a portion of home-related expenses based on the percentage of your home used exclusively and regularly for business.

If your home office takes up 10% of your home’s square footage, the roof replacement expense might be eligible at that 10% rate, assuming it meets IRS home office requirements.

This area gets complicated quickly, so homeowners should keep records and consult a tax professional, especially if the roof replacement is substantial.

If the Property Is a Rental Home

Rental properties operate under a different set of rules. Roof replacement on a rental home is generally considered a capital improvement and must be depreciated over time rather than deducted all at once.

This often benefits rental owners because depreciation becomes a consistent annual tax advantage. A new roof can increase your deductible depreciation expense for years.

If the Roof Upgrade Qualifies for Energy Tax Credits

Some homeowners may qualify for federal tax credits if roof upgrades are directly tied to energy efficiency requirements.

Eligibility depends on:

- The roofing product used

- Certification standards

- IRS credit guidelines for that specific year

Even when credits don’t apply, energy improvements may reduce heating and cooling costs, which is an indirect financial benefit many homeowners overlook.

What Is Included in Roof Replacement? (And Why It Matters for Taxes)

When homeowners ask about tax deductions, they often misunderstand what roof replacement costs actually include. Knowing the full scope helps you compare bids, understand pricing, and keep documentation that supports future tax benefits.

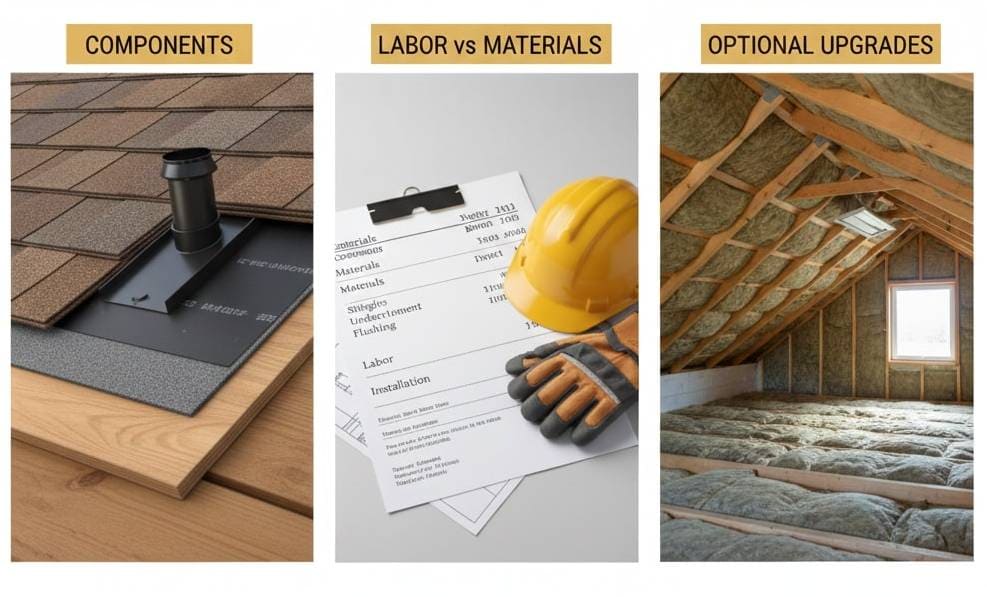

Common Roof Replacement Components

A full roof replacement may include:

- Removal of old shingles (tear-off)

- Disposal of debris and materials

- Replacement of underlayment

- Ice and water shield installation

- Flashing replacement (chimneys, vents, valleys)

- Ridge vents or ventilation improvements

- Drip edge installation

- Ridge cap shingles

- Roof deck repair or replacement (if needed)

When your invoice is detailed, it’s easier to document what is included in roof replacement and keep that information for your records.

Labor vs Materials: How Costs Are Usually Listed

Roof replacement costs usually combine:

- Materials (shingles, underlayment, flashing, ventilation)

- Labor (tear-off, installation, cleanup)

- Permits (if required)

- Equipment or dumping fees

For tax documentation, especially for rental and business use, itemized estimates and invoices are extremely helpful. They clarify what you paid for and what work was performed.

Optional Upgrades That May Affect Value

Some roof replacements include upgrades that can boost home value:

- improved attic ventilation systems

- insulation upgrades

- storm-resistant shingles

- skylights

- new fascia, soffit, or gutters when bundled

These upgrades often strengthen your argument for cost basis improvement and can improve long-term performance and resale value.

Looking for a Roofing Co Near Me? Choose a Local Pleasant Valley Roofing Expert

Homeowners searching “roofing co near me” aren’t just looking for someone to install shingles, they’re looking for someone they can trust with one of the biggest investments in their home.

A roof replacement affects:

- property value

- insurance risk

- energy efficiency

- long-term maintenance

- home resale appeal

- and potentially, future tax advantages through documentation and cost basis

Choosing the wrong contractor can cost you twice: once in repairs and again in missed financial value.

Get a Roof Replacement Estimate (And Keep the Right Records for Tax Season)

If you’re asking, “Is a roof replacement tax deductible?” you’re asking the right question, but the better question is: how can a roof replacement help my finances long-term? For most homeowners, a new roof isn’t a direct tax deduction. But it can still create major financial value when you:

- Track the expense for cost basis

- Document the scope clearly

- Explore home office or rental property eligibility

- Confirm whether energy-related upgrades qualify for credits

If you’re in Pleasant Valley, NY, and need a roof replacement estimate from a trusted local contractor, Roofer of Pleasant Valley can help you understand what your replacement includes, what your options are, and how to protect your home with a roof built to last.

Frequently Asked Questions

Is a new roof tax-deductible to the IRS?

In most cases, a new roof is not tax-deductible to the IRS when it’s installed on a homeowner’s primary residence. The IRS generally considers a roof replacement a personal home improvement, not a deductible expense. However, a roof replacement may provide tax benefits in specific situations.

Can I get a tax credit for replacing my roof?

Possibly, but it depends on what was installed. Most standard roof replacements do not qualify for a federal tax credit, but certain energy-related improvements may. If your roof replacement includes qualifying energy-efficient materials or is part of an approved system (such as certain reflective roofing products or solar-related upgrades), you may be eligible for an energy tax credit under current IRS rules.

What home improvements are tax-deductible according to the IRS?

Most home improvements are not directly tax-deductible for homeowners, but some may provide tax advantages depending on how the home is used or the type of upgrade. Under IRS rules, improvements may be tax-beneficial if they qualify as:

- Energy-efficient upgrades that meet tax credit requirements

- Home office improvements (partial deductions may apply if you qualify)

- Rental property improvements (often depreciated over time)

- Medical necessity modifications (in limited situations)

What roof shingles are tax-deductible?

Roof shingles themselves are usually not tax-deductible for a primary residence. Standard asphalt shingles typically do not qualify for tax credits or deductions on their own. However, certain specialized roofing materials that meet federal energy-efficiency standards may help homeowners qualify for an energy-related tax credit.

Can you file a claim for a new roof?

Yes homeowners may be able to file an insurance claim for a new roof, but it depends on the cause of damage and the terms of the policy. Insurance usually covers roof replacement when damage is caused by a covered event, such as wind, hail, fallen trees, or storm-related damage.